Sweden’s economy is thriving, so why is monetary policy so loose?

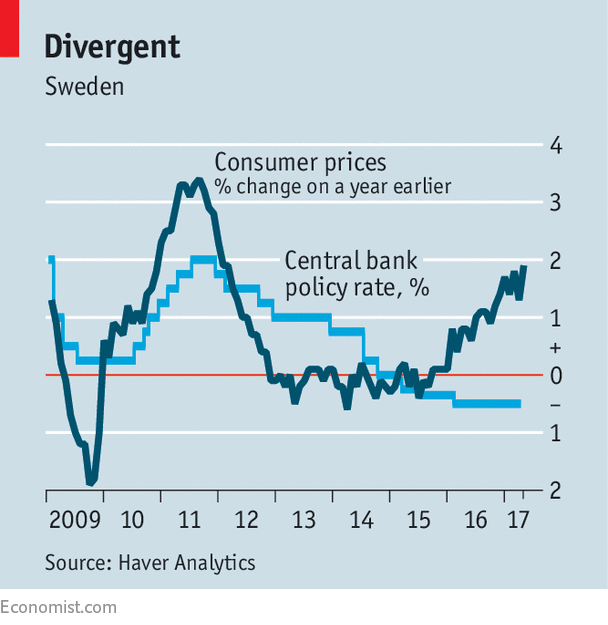

ON A recent balmy day, people thronged the parks and promenades of central Stockholm. Swedes have much to feel sunny about. Real economic growth, at a heady 3.2% in 2016, has averaged 2.8% annually since 2009, compared with the euro area’s 1.1% per year. In April, Swedish inflation was close to the target of 2% aimed at by the Riksbank, Sweden’s central bank. Yet it decided not only to maintain the main policy rate at -0.50%, where it has been since February 2016, but to increase the amount of asset purchases under quantitative easing (QE) by a further SKr15bn ($1.7bn) during the second half of 2017.

One explanation for keeping policy so loose is that the inflation figure is deceptive. Johan Javeus of SEB, a bank, points out that some of the increase was driven by one-off factors, such as rises in air fares and energy prices. After raising rates prematurely in 2010 and 2011, the Riksbank is loth to do so again.

But also, it is hemmed in by the European Central Bank (ECB). The…