Private-equity returns can be replicated with public shares

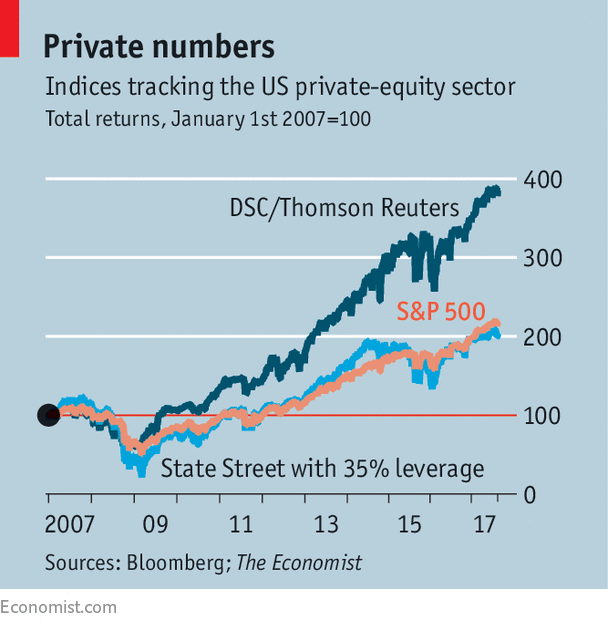

IT IS hard for individual investors to match the returns achieved by private-equity funds. But what if their success in outperforming the public markets could be tracked and replicated? A few pioneering firms claim to have done just that. DSC Quantitative Group, a Chicago-based fund, and State Street, an asset manager, both offer “investable” indices, launched in 2014 and 2015 respectively, that allow investors to mimic the performance of American private equity.

Both firms needed a measure of the industry’s returns. DSC teamed up with Thomson Reuters, a data firm, to compile an index; State Street had been making one since 2004, using data it gleans as a custodian of private-equity assets.

They then match the private-equity risk-and-return profile with a basket of public assets. DSC’s index first matches the sector weights of the private portfolio with equivalent public companies, and adds a modest amount of debt (around 25%) unevenly across the sectors—all using…