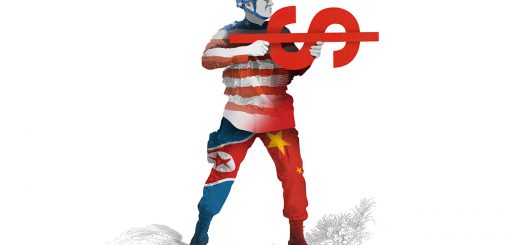

Are China’s state giants reformable?

AMONG investors it is fashionable to say that China’s state-owned enterprises (SOEs) do not matter much any more and that entrepreneurs now power the world’s second-largest economy. But China’s SOEs are still hard to avoid. They account for 40% of its stockmarket and a third of its investment, and they dominate heavy industry. On the global stage, SOEs’ appetites sway commodity prices and many are expanding abroad.

These empires of men and machines account for 45 cents of every dollar of debt in China, so their health determines whether the country’s financial system will escape a crisis or blow up. And SOEs have become a loaded gun on the negotiating table between China and America. Treasury officials argue that China has broken the promises it made upon joining the World Trade Organisation in 2001 about further liberalising its economy. According to one negotiator, it is “abusing the system” by subsidising SOEs which in turn rig markets, dump cheap exports abroad and deter foreign…